In the real world all Child Benefit payments will be cut

We should take claims that Child Benefit and child income support have been spared with a pinch of salt. By Michael Taft.

When we move from the numbers in the budget papers out into the real world we find that Child Benefit and child income support has been cut again – not only for larger families but for all families. The instrument for this cut is that most effective stealth tax of all: inflation. If I have €100 and inflation goes up by 5% – in ‘real’ terms, that €100 is reduced by €5. I can now buy only €95 worth of goods and services. Inflation cuts income as surely as Government spending cuts and tax increases cut income.

So let’s go into the real world and see what will happen in real terms (that is, after inflation). We have two recent projections on inflation (using the EU’s Harmonised Index of Consumer Prices). The Government projects that inflation will rise by 1.2% while the ESRI projects 1.9%. The ESRI figure is higher because they have included the impact of the prospective VAT rise on prices.

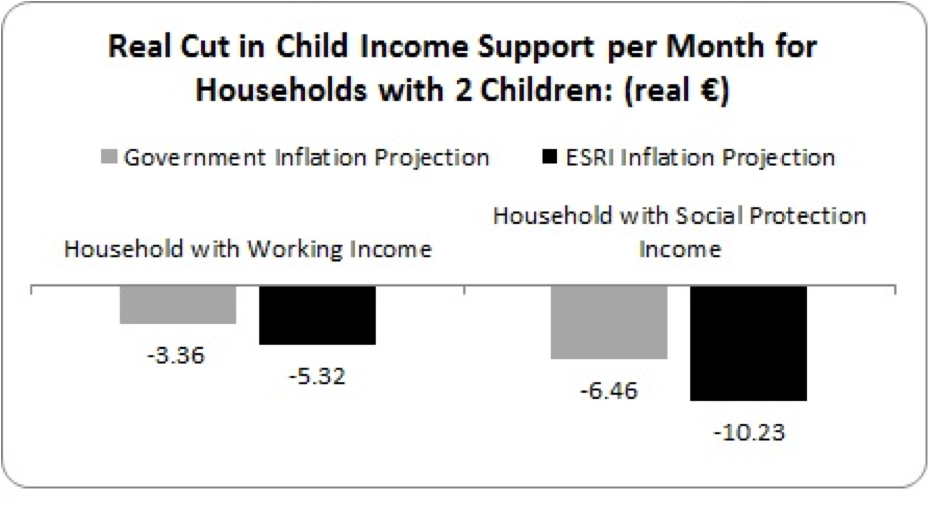

Let’s first turn to the impact on families of the standard Child Benefit rate (families with two children) and Child Dependency Allowances – payment made to households on social protection income.

For all households with two children there will be cuts in real child income support. For those in work with two children, the Child Benefit cuts will range from €3 to €5 per month.

For those on social protection income, the cut will be worse – as they rely on both Child Benefit and Child Dependency Allowances. These cover over 260,000 families. These real cuts will range from €6 to €10 per month.

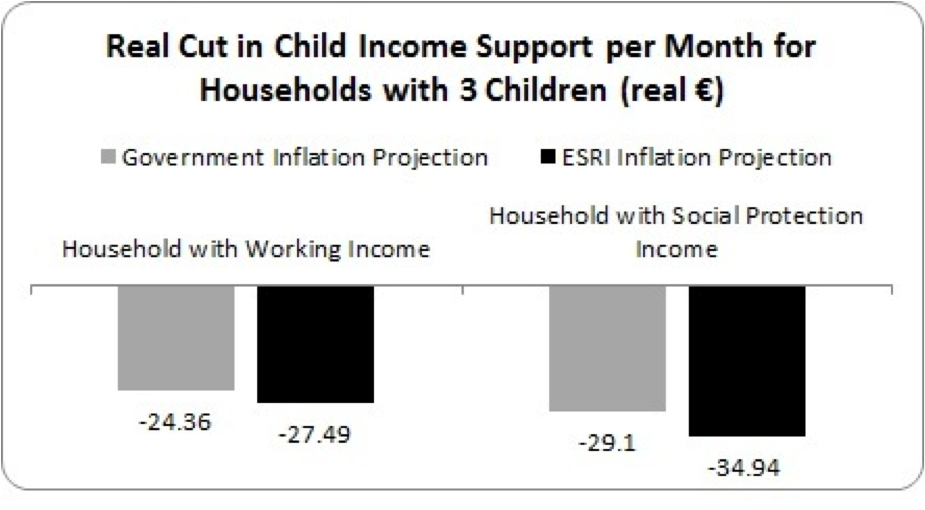

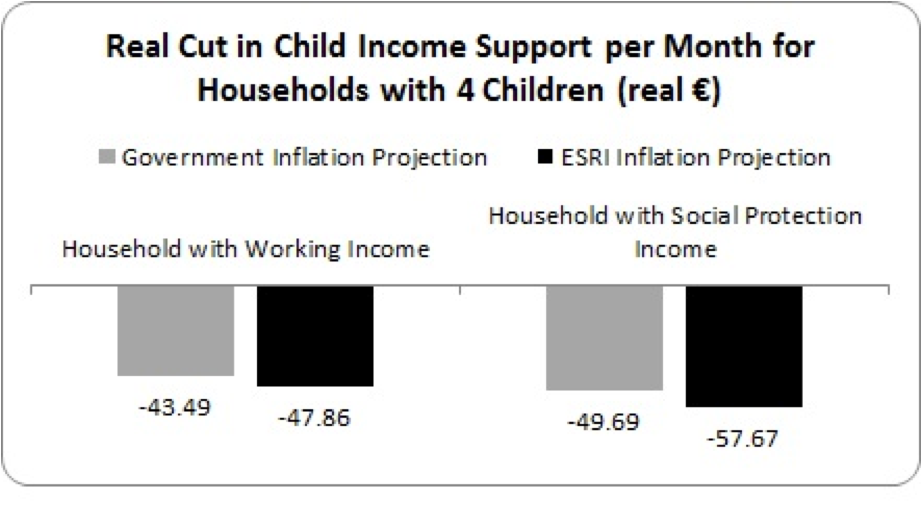

When we turn to larger families, however, the situation is worse, as there have been cuts in the headline rate along with the cuts produced by inflation. The supplement for the third and fourth child has been cut by €19 and €17 respectively. This will affect nearly 25% of all families in receipt of Child Benefit – or over 136,000 families and some 60,000 families on social protection income.

Families with three children are facing substantial monthly cuts. For those with working income, the cuts could range between €25 and €27 per month. For those on social protection income the cuts will increase to between €29 and €35 per month.

Families with four children will, of course, be hit even harder. For those on working income, the cuts will range between €43 and €48 per month while those on social protection income will be hit by a substantial €50 to €58 in cuts per month.

There are two sides to this coin. First, people will be able to purchase less with their child income support; this will reduce living standards at a time when real wages and incomes (taking into account our old friend, inflation) will continue falling next year.

There will also be an impact on domestic businesses. These households, with falling real incomes and real cuts in child income support will reduce their spending. This means less turnover in businesses throughout the country. This will impact on employment in those firms – either in terms of reduced wages, reduced working hours or reduced jobs.

To conclude, we should treat claims that Child Benefit and child income support have been spared sceptically. This may be true for numbers on the budget papers. But once families take that income support into the real world they will find that the value will be cut – and in some cases, substantially.

No wonder a lot of people will find their living standards cut in 2012 – a long slow bleed. {jathumbnailoff}

Image top: infomatique.