Poorer and more unequal

While other EU countries have taken steps to prevent low-income groups from disproportionately suffering as a result of the recession, in Ireland we get poorer and more unequal. By Michael Taft.

At a meeting of Labour Party activists, Dr. Mary Murphy – a leading academic and activist – made the following statement:

“We may be a poorer country, but that does not mean we must be a more unequal country.”

It is one of those statements that merit considerable attention and investigation. I’d like to present some evidence that unfortunately shows that we are both poorer and more unequal.

No one doubts we are poorer as a nation (though that doesn’t mean everyone is poorer). In the period between 2007 and 2010, Ireland’s Gross National Income (which reflects our GNP) fell by a massive 21%. So how much more unequal are we?

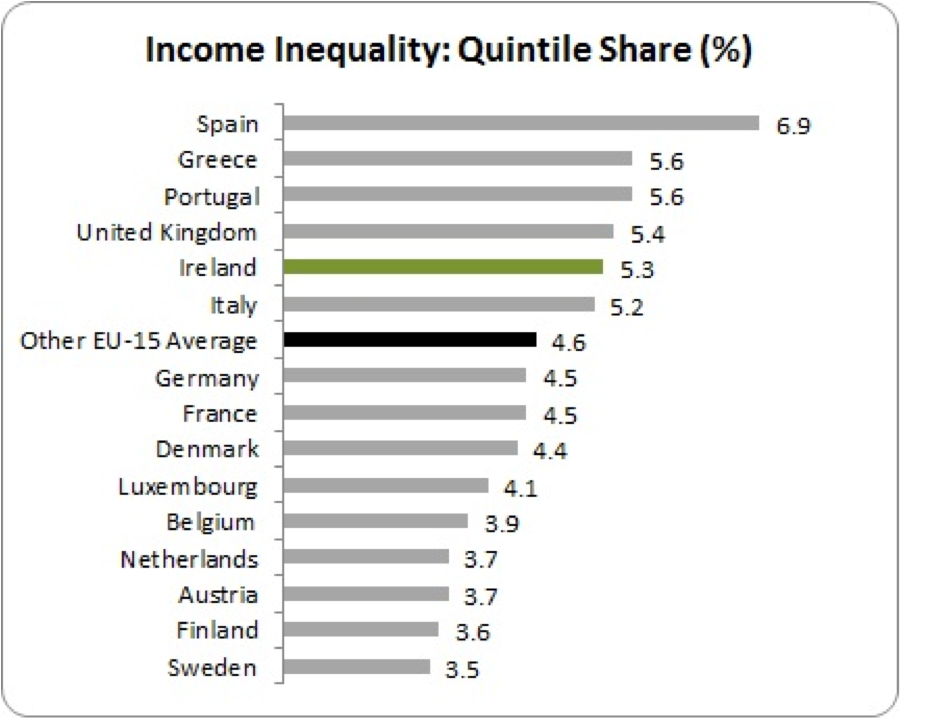

The EU’s measure of income inequality is the quintile share ratio – the ratio of equivalised disposal income of the top 20% to that of the lowest 20%. As seen, Ireland is in the top five, well above the average of the other EU-15 countries.

What is noteworthy is that in 2009, Ireland’s quintile ratio was 4.2. The jump to 5.3 a year later represents the biggest single-year increase in inequality of any EU country since this measurement began in the late 1990s.

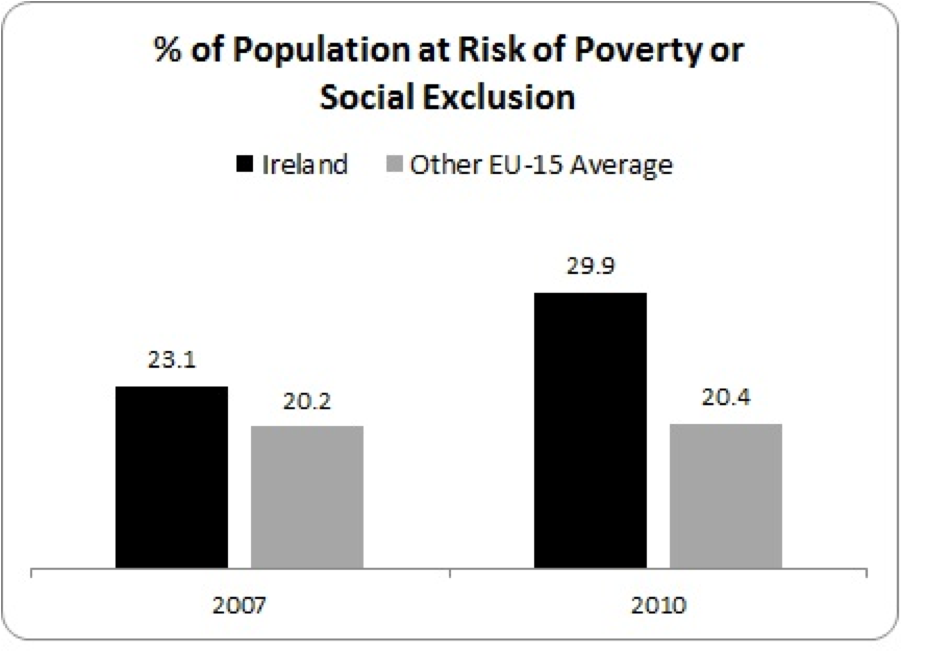

But inequality ratios only tell part of the story. We have seen that nearly one in four of the population suffers two or more deprivation experiences. But there are other measurements the EU uses as part of its Europe 2020 strategy for inclusive growth. In particular, it measures the share of the population that is at-risk of poverty or social exclusion. This is made up of those who have incomes below 60% of median income, suffer at least four out of nine deprivation experiences, or (for those aged below 60 years) live in jobless households.

As seen, Irish rates were above the average of other EU-15 countries in 2007, but not by a significant amount. However, while EU rates remained the same, Irish rates increased substantially – by 29%.

As seen, Irish rates were above the average of other EU-15 countries in 2007, but not by a significant amount. However, while EU rates remained the same, Irish rates increased substantially – by 29%.

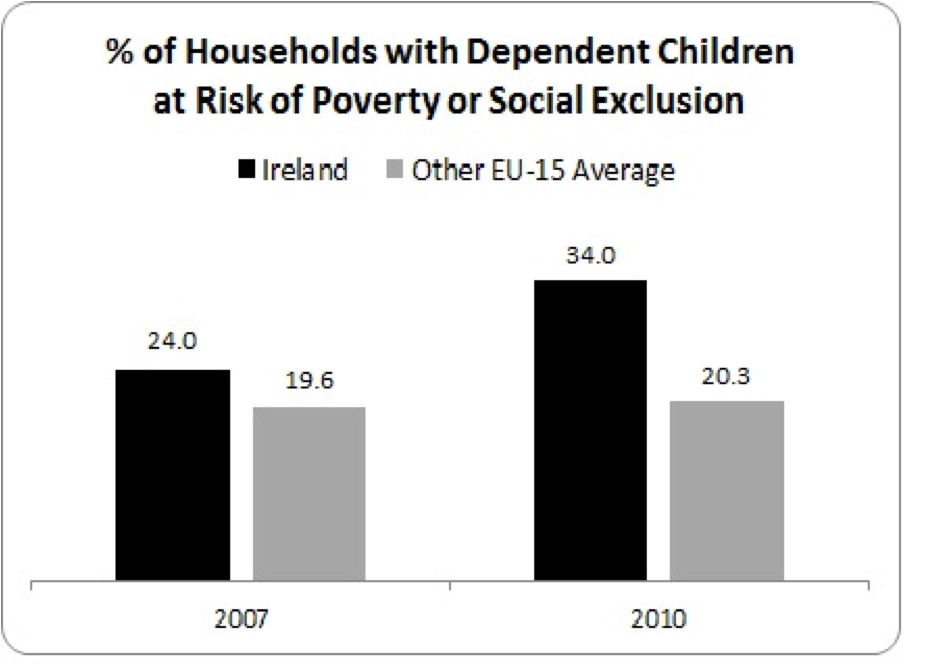

Households with dependent children are at even more risk of poverty or social exclusion.

We see a similar pattern: Irish poverty/social exclusion rates are above the average of other EU-15 countries prior to the recession but have increased substantially while the rates in other countries have remained stable.

We see a similar pattern: Irish poverty/social exclusion rates are above the average of other EU-15 countries prior to the recession but have increased substantially while the rates in other countries have remained stable.

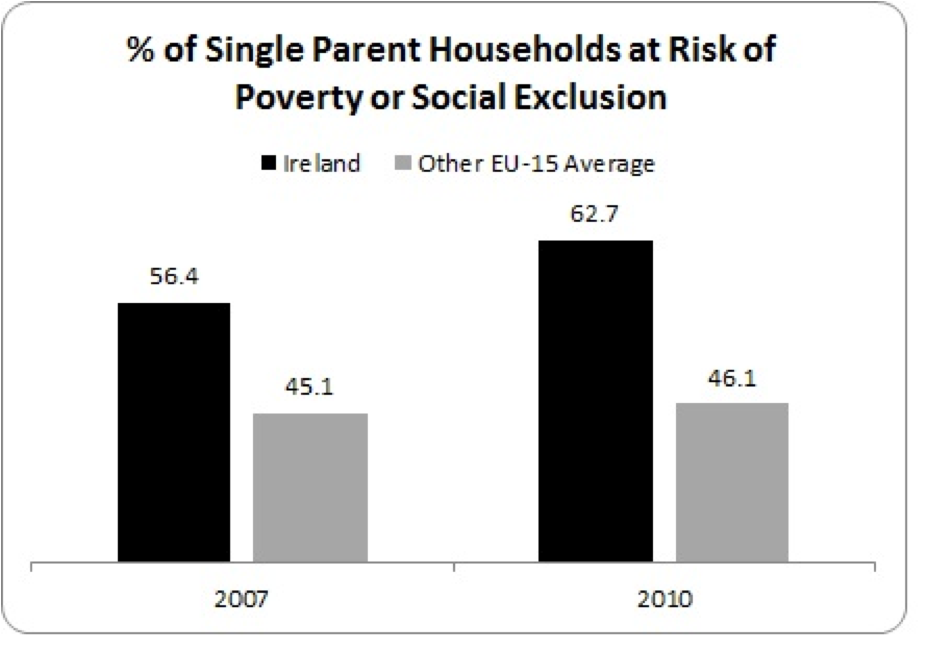

However, it is single adult households that are really taking the brunt of the recession in Ireland.

Single parents throughout Europe are at high risk of poverty or social exclusion, but Irish rates were not only higher prior to the recession, they increased substantially up to 2010, while EU rates remained broadly the same. Nearly two-thirds of single parent households in Ireland are at risk – a truly appalling figure.

Single parents throughout Europe are at high risk of poverty or social exclusion, but Irish rates were not only higher prior to the recession, they increased substantially up to 2010, while EU rates remained broadly the same. Nearly two-thirds of single parent households in Ireland are at risk – a truly appalling figure.

What has been the current Government’s response to this escalating rise in poverty or social exclusion risk – in particular, for single parents? They are making it even worse. The new campaigning group SPARK (Single Parents Acting for the Rights of our Kids) has listed the impact of measures from the last budget on single parents. Here is just a sample:

- Reduction in income disregard from €146.50 to €130 with plans to lower this to €60 by 2016.

- Abolition of the second child payment to lone parents on Community Employment schemes, amounting to €29.80 per child per week

- The Back to School Clothing and Footwear Allowance has been cut by €50 for primary schools and €55 for secondary school children.

- The Fuel Allowance has been cut by 6 weeks pa, resulting in a €120 annual reduction (or an annualised €10 per month).

- Rent contributions from tenants under the Rent Supplement scheme has been increased by €6 per week or €312 a year.

- The temporary payment of half of the rate of One-Parent Family Payment where the recipient's earnings exceed €425 per week will be discontinued for new claimants from 5 January 2012.

- Currently people getting One-Parent Family Payment can get half-rate Jobseeker’s Benefit, Illness Benefit or Incapacity Supplement if they satisfy the qualifying conditions. These half-rate payments will cease for new applicants.

- New participants on Community Employment schemes will not be able to claim One-Parent Family Payment at the same time.

- For new and existing claimants, income from employment as a home help funded by the HSE will be assessed in means tests for the One Parent Family Payment, from 1 January 2012.

This constitutes a sustained and substantial attack on households that suffer the most from poverty and social exclusion. That this has been done under a Labour Minister is all the more depressing.

This is not only socially obscene, it is economically irrational. Every euro taken from low-income groups – in the case of lone parents, ultra-low income – is a euro reduction in domestic demand. This, in turn, puts more pressure on businesses, especially businesses in low-income areas. This pressure can result in reduced payroll (which reduces tax revenue) and even job losses (which increases public expenditure). At the end of the day, the Government may think it’s ‘saving’ money, but it only ends up robbing both Peter and Paul, leaving all of us the poorer and with no appreciable increase in deficit reduction.

And don’t forget, the figures above only go up to 2010. Budget 2011 contained social protection rate cuts along with cuts to child income support; while the last budget contained more social protection cuts along with regressive tax measures (VAT and Carbon tax rises as well as the flat-rate household charge) that will impact disproportionately on low-income groups. We should expect these figures to get worse as new yearly data comes on stream.

This is a political outcome. While recessions, of their very nature, bring job losses and working-income loss, countries can create social structures that ensure that people do not fall into poverty or social exclusion risk with either automatic stabilisers (social protection payments that create a floor against deprivation) or emergency measures that prevent a social slide.

While other EU countries have taken steps to prevent low-income groups from disproportionately suffering as a result of the recession, in Ireland we get poorer and more unequal.

We get both insult and injury. {jathumbnailoff}

Image top: Truthout.org.