Our debt may yet overwhelm us

The Greek government is in negotiations with private sector creditors to reduce its debt burden. Ireland is indeed, "not Greece". By Michael Taft.

Ireland is not Greece: we get a lot of that from Government ministers, Troika officials and commentators. This truism, however, says less than it purports to. Yes, Ireland is not Greece. Ireland is not Belgium, Romania, Brunei, the Yukon Territory or Idaho, either. Of course, the message is that Greece is a basket-case that no investor would want to go near for decades; whereas they are ready to queue up to lend to Ireland in bucket-loads. Therefore, the more we can distinguish ourselves from Greece, the quicker we can get back to business as normal.

But there’s one interesting measurement that shows that Ireland is definitely not like Greece – it’s actually worse.

When one looks at overall government debt, it seems that, while Ireland is in a bad state, Greece is far, far worse (all estimates are based on Irish Government and IMF projections).

2015 government debt as a % of GDP

- Greece: 165%

- Ireland: 115%

Okay, we’re above the projected Eurozone average (88%) but, whew, at least we’re not like Greece.

However, when we remove international flows (e.g. profit repatriation, etc.) and use GNP, or GNI which is almost the same thing, the comparison alters (Greek GNI is assumed to be the same proportion of the GDP in 2015 as in 2010).

2015 government debt as a % of GNP

- Greece: 168%

- Ireland: 145%

We’re still not like Greece, but the debt gap is starting to narrow and the instrumental medleys are starting to play in the same key.

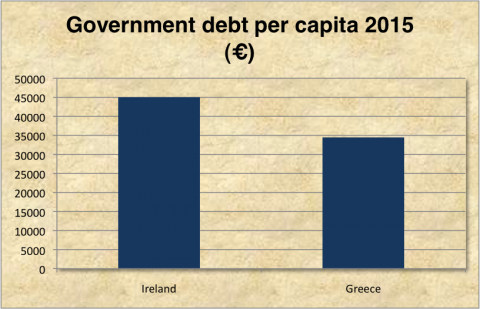

But let’s look at one more measurement, to get a sense of how much debt the residents of each country are carrying.

2015 government debt per capita

- Ireland: €45,004

- Greece: €34,474

This is quite a turnaround. Irish residents will be carrying a far heavier load than Greek residents. We do have an advantage in that we have a younger population, but can we make that advantage work or, as the Minister for Finance suggests, will we have to be content in investing in our children’s education to ensure they have job opportunities in other countries? We have other strengths – a modern export base, regardless of how detached that may be from the domestic economy; a more efficient public sector, though this is quickly being downgraded with the continuing cuts; and the fact that our debt has not (yet) reached officially unsustainable levels, though that ‘official’ level is opaque and moveable.

All this might be thrown into doubt, though, with the constitutionally mandated austerity pact coming down at us from the Eurozone and the continuing slow bleed of demand in the economy. It may still be the case that our debt will overwhelm us.

The point here is that mindlessly chanting “We are not Greece” is not a substitute for analysing what exactly we are – a highly indebted country with projected debt levels that grow every time the Government revises its growth projections. Last year, the Government made three revisions to its 2015 projections for debt to GNP ratio:

- April 2011: 140.2%

- November 2011: 143.3%

- December 2011: 145.2%

We should expect another revision upwards when the Government produces its update in April – with the IMF and independent forecasters projecting lower growth rates for next year. Worryingly, Goodbody projects that debt as a percentage of GNP will be approximately 155% by 2015. And, of course, none of this includes the extremely high levels of Irish personal debt.

The Greek government is in negotiations with private sector creditors to reduce its debt burden. Ireland, with a higher debt per capita, is giving full commitments to pay the creditors – not just of state debt but bank debt as well; even banks that no longer exist.

Indeed, Ireland is not Greece. {jathumbnailoff}