Hanging out in the EU basement

The average projected growth rate for countries not in bailout in the EU over the next two years is 2.1%. Ireland's projected growth rate is 0.1%. This is a figure that should alarm and depress us. By Michael Taft.

If one were to look at the headline rate – GDP – you’d say, well, it’s not great in Ireland but we’re doing better than the Eurozone. After all, the EU Commission is now projecting the Eurozone to grow by an anaemic 1.8% over the next two years while they estimate Irish GDP growth to increase by 3.4%. So, yes, the next two years will be grim but there’s grim and then there’s grimmer.

However, when one looks below the headline rates, another picture emerges – of an Irish economy falling further behind Eurozone averages. When we remove the froth of the multinational driven export sector (an ‘enclave’ as the IMF described it), we see our economy for what it is: a sluggard. Let’s run through the EU Commission’s projections for some of the key domestic indicators, covering the next two years:

Consumer spending: Eurozone private consumption is expected to rise by 1.4%; Ireland, 0.6%

Government consumption (spending on public services): the Eurozone will be increasing spending on public services by 0.1%; Ireland will be cutting spending by 3.1%. No surprise there. But even the Eurozone average is distorted by the countries in the bailout massively cutting back (Greece: 16.0%; Portugal: 10%).

Investment: One area where Ireland does slightly better – with investment expected to grow by 4.8% compared to a Eurozone average of 3.4%. But there is a context here: since 2007 Irish investment has fallen by (wait for it) 74%. The Eurozone fell by only 11%.

Unemployment: In 2013, unemployment is expected to be 10% in the Eurozone; in Ireland it is expected to be close to 14%.

Employment: the Eurozone average will only grow by 0.3% – pretty miserable given the levels of unemployment. Ireland won’t even reach that: employment will flatline over the next two years.

All in all, domestic demand is expected to fall by 0.5% in Ireland over the next two years. In the Eurozone, domestic demand will increase by 1.5%.

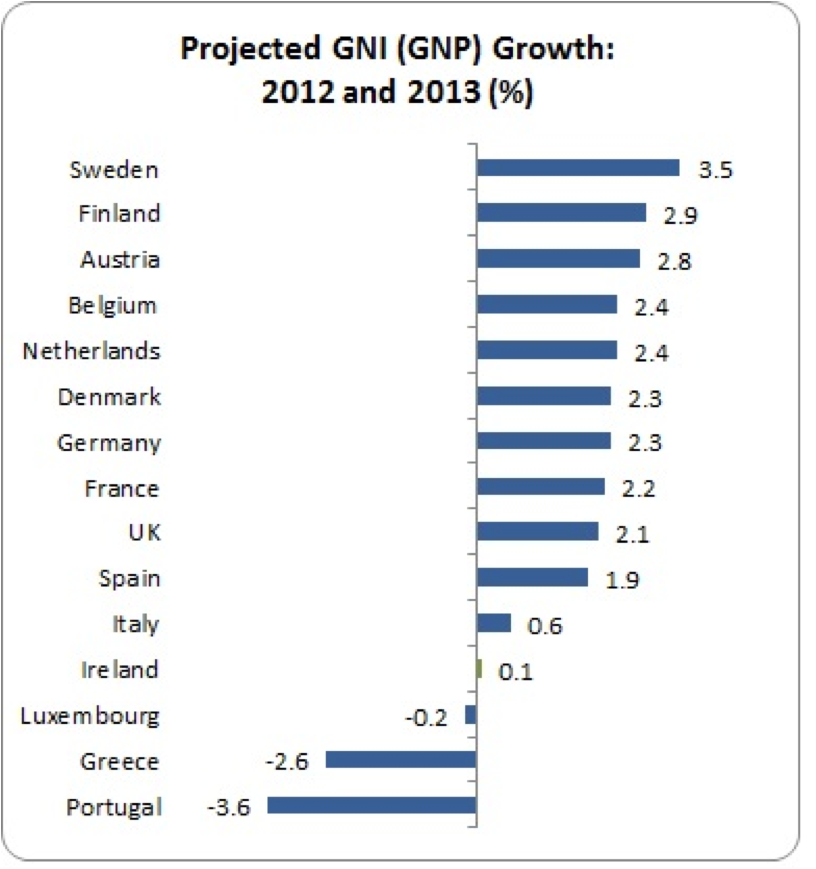

Still, there will be those who will hang onto the GDP numbers – mostly Government ministers and the cheerleaders for austerity. But there’s another measurement that the EU helpfully provides: Gross National Income – which is essentially GNP. Where does Ireland stand in the Eurozone tables regarding domestic growth?

Ireland is well down the table. Irish GNI/GNP is expected to “grow” by 0.1% over the next two years. The average growth for other EU-15 countries is 1.4%. But the average growth for those countries not in bailout (excluding Ireland, Greece and Portugal) is projected to be 2.1%. 2.1% to 0.1%: that is the comparative measurement that should alarm and depress us.

We don’t need the rhetoric of the Medium Term Fiscal Framework – the “emerging” recovery, the “nascent” recovery. We don’t need Government spokespersons going on about “staying the course”.

What we need is an open and honest dialogue about our growth prospects – the upsides and the downsides. And we need to put those growth prospects in a comparative context so that we may be able to debate why some countries and some policies are more successful than our own (or, at least, less damaging).

The sooner we get that dialogue started the better. In the meantime, we’ll just be hanging out in the EU basement. {jathumbnailoff}

Image top: per.olesen.