Government gives with one hand, takes with the other

The cut in VAT is no more than ineffectual fiddling at the margins and won't help to create jobs. By Michael Taft.

At the heart of the Government’s emerging policy lies a profound dislocation and contradiction. Its Jobs Initiative is intended to promote consumer spending - a valid enough goal. Consumer spending has collapsed (by 10 percent) in comparison with the Eurozone average (less than 1%). Of course, consumer spending is not going to dig us out of the recession (at least I hope the Government realises this); this will only occur when investment returns with force. But it can provide a breathing space.

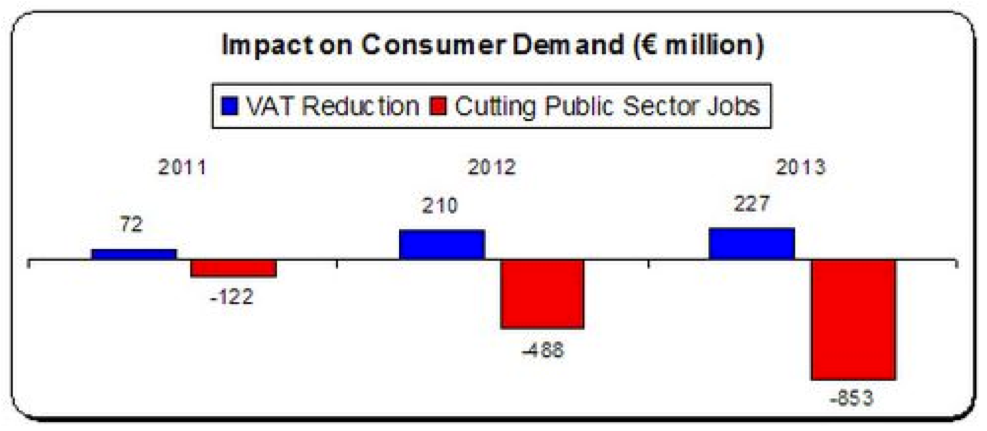

The problem here is that while the Government gives with one hand, it takes away much more with the other. And the way it ‘gives’ is pretty leaky. Let’s examine the impact of two policies on consumer spending: the VAT reduction and the reduction of the public sector payroll.

We have a measurement for the impact of cutting public sector jobs on consumer demand, from the ESRI. We don’t have an assessment for VAT reductions. How much extra spending can we expect from temporarily reducing the low-rate of VAT to 9%? It depends on two factors – how much will prices fall and will this fall induce increased consumer spending. We’re into a lot of guesswork here.

There are many reasons why businesses won’t pass on the VAT cut, at least not in full:

- Business will use the VAT reduction to improve cash flows, especially those businesses that don’t have access to credit.

- Businesses will attempt to repair profit margins – valid enough when prices have been falling and costs rising (this is what a spokesperson from the hairdressers sector said on Morning Ireland – consumers won’t experience any fall in prices).

- Some businesses don’t need to pass on VAT: Dublin hotels are increasing turnover, profitability and room occupancy – they may calculate that the VAT cut can be redirected into profits.

- The VAT cuts will merely subsidise rising costs: for instance, food and drink prices rose by 1.6% in the last year with further price rises forecast.

Consumers may not respond with increased spending either – they may pocket any savings from their current spending and use that to pay off debt and get out of arrears; or save more because they are still dubious about their future.

For all these reasons the VAT cuts won’t be passed on in full in all circumstances and where they are, it may not increase spending by a significant amount. And among all the instruments to stimulate the economy, cutting VAT is one of the least effective. According to this IMF study, for every €1 spent on reducing VAT, consumer spending is expected to grow by approximately 60 cents in the first year and 65 cents in the second year.

So for the purposes of the following calculation, I’m assuming that consumer demand will rise by 60 to 65 percent of the VAT reduction stimulus. I compare that with the estimated impact on consumer spending from cutting the public sector payroll.

Any gains from the reduction in VAT will only mitigate the fall that is being caused by the Government policy of cutting the public sector payroll. Now include all the other deflationary policies the Government is pursuing (cutting contracts to the private sector, investment, coercive labour market measures, water charges, eventual VAT increases, etc.); the Government’s policies are sucking demand out of the economy.

Of course, there could be additional gains if the VAT reduction induces more tourist numbers – but tourism is partly about the destination, and partly about the economic situation in the country of the traveller. If growth and employment is sluggish in, say, the UK, we shouldn’t expect a big increase in travellers coming from that jurisdiction. And in its recent Stability Programme Update, the Government revised downwards future UK growth rates by significant amounts.

Let’s get some perspective – this is all about fiddling at the margins. The Government is expecting consumer spending to fall by nearly 2% this year (or over €1 billion) and flat-line next year. The VAT measures are unlikely to counter this is to any significant degree.

As long as the Government is stuck in austerity mode, counter measures will be small and ultimately ineffectual because their main policies are so large and deflationary.

notesonthefront.typepad.com