Chasing mice while elephants destroy the house

We need some discussion of the fact that all the main economic indicators are going south. But what we get instead are wall-to-wall demands that the Government cut €75 million in public sector allowances. By Michael Taft.

We’re really lucky to have public sector workers to kick around – what with all their allowances and increments. If we didn’t, media and commentary would have to give more attention to the two CSO reports that came out last week. The first, discussed here, showed the economy destroying 1,200 jobs a week. The second, discussed below, shows a continuing downward trend, confirming that just when you thought it couldn’t get any worse, it gets worse.

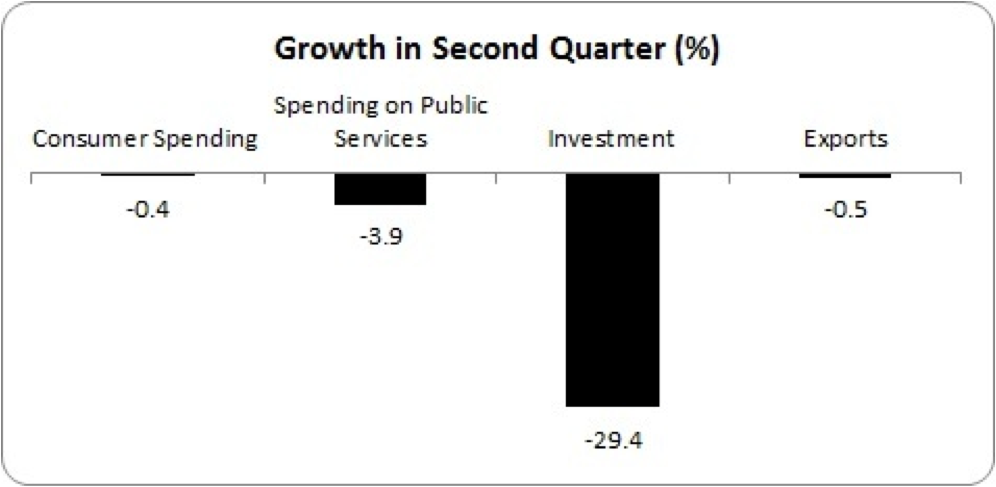

The CSO’s Quarterly National Accounts (provisional) showed all the main indicators going south.

The only reason that overall GDP flatlined was because imports fell faster than exports, declining by 5.2%. If anyone thinks this is a good thing, just remember: most imports are business imports. And given that the multi-national sector is probably holding up well, this indicates that indigenous business is coming under even more pressure.

The only reason that overall GDP flatlined was because imports fell faster than exports, declining by 5.2%. If anyone thinks this is a good thing, just remember: most imports are business imports. And given that the multi-national sector is probably holding up well, this indicates that indigenous business is coming under even more pressure.

Just to note: the investment category is not as bad as it appears. In the first quarter, investment jumped 26%, but this was primarily on the back of one sector – aircraft leasing. Averaged out over the two quarters and investment fell by far less - but it fell nonetheless.

Another indicator, GNP, shows an increase of 4.3%. But, again, look below the headline and see a reason that has nothing to do with the health of the domestic economy. GNP is arrived at by subtracting the flows of money out of the economy, a large part of which are repatriated profits. In the second quarter, there was less money flowing out than in the first quarter. If it had been the same, GNP growth would have been 1.5% – a growth facilitated by the fall in imports (Seamus Coffey has a good discussion of GNP here).

Anywhere you look there are few silver linings – with the exception of the growth in industry. But the multinational-dominated industry makes up only a quarter of total output and its rise couldn’t make up for the fall in all the other sectors.

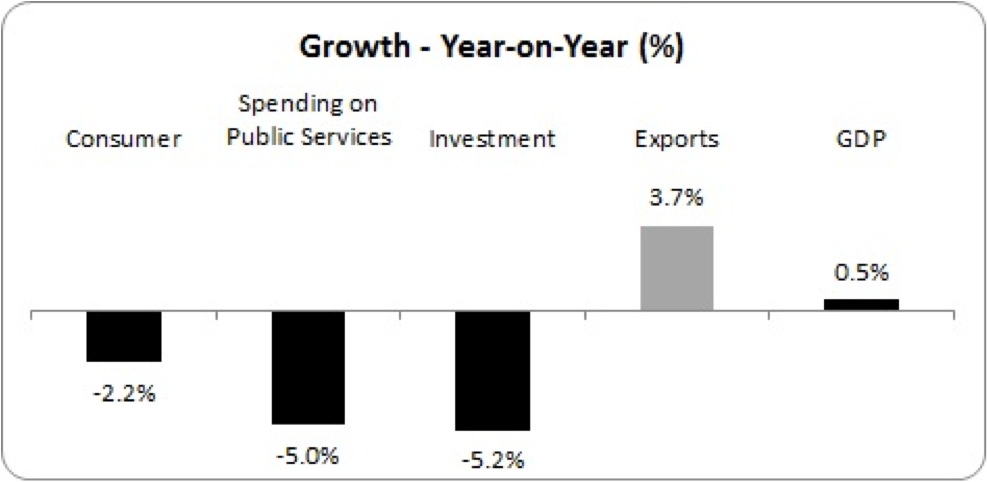

The above compares the quarterly results. Year-on-year comparisons suggest that we are, at best, stuck in a trough.

The domestic indicators are all going south. GDP is lower than it was this time last year. What’s holding up overall GDP is the growth in exports, with a fall in imports of 1.1%.

And it’s not like there hasn’t been other portentous news in September. The Exchequer returns showed that for the second month in a row, tax receipts fell behind last year’s level for the second month in a row – indicating that public finances are weakening. That, too, was worthy of some discussion.

But no. What we get is non-stop, wall-to-wall demands that the Government cut €75 million in public sector allowances, regardless of how many (if not most) are wholly legitimate by any measurement in the private or public sector. And if the Government did cut this money? How much would it save on the deficit, as a percentage of GDP? 0.032136%.

Yet, over the last six months 1,200 jobs are being lost a week while €899 million has been wiped off domestic demand, resulting in weakening public finances and even more misery in society.

We are invited to chase after mice while the elephants, which get only cameo parts in the debate, trash the house. Oh, well, I guess it’s more fun chasing the mice. Unfortunately, by the time we catch them we won’t have a house to live in.

Image top: paral_lax <°)><