Budget 2013: 'Deeply regressive, both socially and economically'

Social Justice Ireland have this morning released a detailed response to Budget 2013. The group describes the Budget as “unjust and regressive", adding that "It does nothing to foster economic recovery or to provide a vision and direction for the country."

They say: “There is a profound lack of any guiding vision that would suggest Budget 2013 was moving Ireland towards a future where everyone had access to the basics required to live life with dignity.

The choices Government is making are undermining Irish society and dismantling the social model that has underpinned Ireland’s development for more than half a century. Fair and balanced development is being replaced by choices that are producing a deeply divided two-tier society.”

You can read a summary of SJI’s critique below, or read the full document here.

Socially regressive

Socially the Budget hits people on low incomes, including the working poor, more than it hits the better off. Low-income` households have taken a wide range of ‘hits’ . The cumulative impact of the various initiatives contained in Budget 2013 on those who are vulnerable will be devastating in the years ahead.

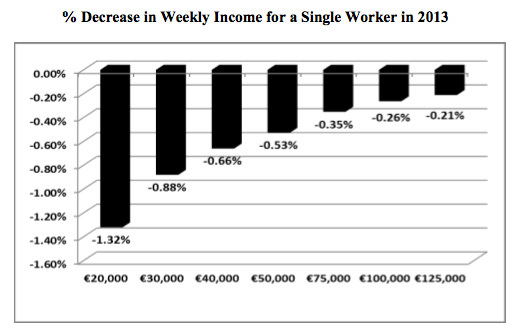

The change in PRSI, for example, will hit the working poor far more than it will hit those with incomes above €100,000 a year.

Budget initiatives on pensions will take less from the pensions industry than before and will leave the pension tax-break in place, both of which benefit the better off.

Budget initiatives on pensions will take less from the pensions industry than before and will leave the pension tax-break in place, both of which benefit the better off.

The carbon tax was increased but no compensating mechanism was put in place for poor or rural households who are again hit disproportionately by this tax. At the same time Government found €70m to provide tax relief on excise duty for auto-diesel to road hauliers.

Economically regressive

Economically it fails totally to address unemployment. Domestic demand is set to fall again and the projected increase in employment is aspirational and minimal.

Unemployment is set to fall but this will occur because emigration will continue.

Without a substantial increase in investment there will be no increase in jobs on the scale required. Without jobs there will be no recovery. Without recovery Ireland will remain mired in austerity for the foreseeable future.

In reality the current approach by Government to resolving Ireland’s series of crises is not working. In fact it is running down the economy.

Despite taking almost €28bn out of the economy in tax increases and expenditure cuts since July 2008 we are still left with 700,000 people at risk of poverty, falling domestic demand, record levels of long-term unemployment, rising emigration and 100,000 households on waiting lists for accommodation.

Economic recovery

Ireland urgently needs an investment of sufficient scale to create the jobs which are essential if there’s to be a recovery. In our Policy Briefing on Budget Choices Social Justice Ireland proposed that Government provide an investment package of €7bn for the domestic economy over the next three years to drive Ireland's recovery.

This focused, off-balance sheet programme would have had the dual impact of increasing domestic economic activity while also addressing some of the social and infrastructural deficits which remain in Ireland. Budget 2013 contains no initiative on the scale required.

Recent research by the Nevin Economic Research Institute (NERI) has shown that an investment programme can yield substantial employment gains while protecting Government finances.

No real addressing of unemployment

The Government is projecting that unemployment will be at 14.6% of the labour force in 2013 and still be at 14.1% in 2014. For the first time in Ireland’s history 60% of those unemployed have been in that situation for more than a year.

The implications of this situation for people, families, social cohesion and the exchequer’s finances have already been very serious and are likely to continue as such.

Cumulative impact will be devastating

Budget 2013 contained many measures that will impact on families, particularly those with children and those on lower incomes.

A family could, as a result of this Budget, be hit by all of the following: reductions in Child Benefit, the abolition of the PRSI allowance, the introduction of a property tax, the trebling of the prescription charge for medical cardholders, the increase in the Drug Payment Scheme threshold and the abolition of the Cost of Education Allowance.

Those measures in detail:

· the reduction of €10 a month in child benefit for the first and second child, €18 for the third child, and €20 for the fourth and subsequent child;

· the abolition of the PRSI allowance which increases PRSI by €264.16 for those working and eligible to pay PRSI contributions;

· the introduction of the Local Property Tax;

· the trebling of the prescription charge for medical card holders to €1.50 and increase in the monthly cap for a family to €19.50;

· and the increase in the Drug Payment Scheme threshold from €132 to €144;

· the abolition of the Cost of Education Allowance of €300 which will affect unemployed and lone parents.

These multiple cuts will affect families on low incomes and families with a lone parent disproportionately as the across the board cuts in child benefit and abolition of the PRSI allowance are regressive, as wealthier households can afford to absorb cuts and tax rises unlike households surviving on low incomes.

These multiple cuts will affect families on low incomes and families with a lone parent disproportionately as the across the board cuts in child benefit and abolition of the PRSI allowance are regressive, as wealthier households can afford to absorb cuts and tax rises unlike households surviving on low incomes.

Budget 2013 continues the pattern of recent budgets in reducing expenditure in multiple areas, which combine to significantly reduce the income of many families.

It is unjust that corporations maintain and receive tax relief in Budget 2013 while families continue to suffer the brunt of budgetary adjustments.

If the family was already vulnerable or in poverty, the cumulative effects of these initiatives will have a devastating effect on their already precarious situation. The long-term impacts for society of these Government choices will be very negative.

Social services being eroded

The social infrastructure is being undermined by Government without any regard to the long term consequences of these actions. Those who are poor and/or vulnerable are bearing an inordinate part of the burden of restructuring. Government has made no assessment of what the long term impacts of the cuts to services and service reductions will mean for Ireland in ten years’ time.

Cuts to services (such as health, education, disability) particularly affect those with least income who do not have sufficient means to compensate for them. Furthermore, many services are provided by NGOs, but in many cases their funding has been cut or withdrawn by the State in recent years.

Regressive societal changes are being imposed

The choices Government is making each year in its annual Budget are, in fact, societal choices with major consequences for the future shape of Irish society. (see p.7)

For example, there is marked contrast between how children were treated in Budget 2013 and how corporations were treated. While households with children saw their incomes reduced, the corporate sector was not asked to make any contribution towards financing Ireland's recovery. Not alone that - they were given further tax reliefs. Similarly, the contribution sought from some politicians, public servants, bankers and well-off civil servants was minimal.

There is a profound lack of any guiding vision that would suggest Budget 2013 was moving Ireland towards a future where everyone had access to the basics required to live life with dignity.

The choices Government is making are undermining Irish society and dismantling the social model that has underpinned Ireland’s development for more than half a century. Fair and balanced development is being replaced by choices that are producing a deeply divided two-tier society.

The Government has no mandate to make societal choices that move Ireland in this direction.

Reducing the deficit by creating a fractured society, a weak economy and persistently high unemployment is not a recipe for recovery. Ireland needs a new approach which prioritises investment, promotes public services, protects vulnerable people and communities and ensures its development is underpinned by an equitable tax system. Budget 2013 fails all these tests.