Argentina: a heterodox success story

In the 1990s, Argentina was an IMF poster boy, but it soon became a byword for the failures of the Washington Consensus. Tying its currency to the dollar, cutting public spending and selling its assets led to a deepening debt spiral from which it could not escape, until it defaulted. By Nick Pearce.

Christina Fernandez has won a thumping victory in Argentina’s Presidential elections, securing 53% of the popular vote to win by the largest margin in the last four decades. Such a resounding success looked highly unlikely a few years ago, when her personal popularity had slumped and the economy was buffeted by the global financial crisis.

But underneath the ebb-and-flow of events, the Argentinian economy has posted remarkable success during the years it has been governed by Fernandez and her late husband, former President Nestor Kirchner, who died last year. Since its catastrophic collapse in 2001, when the country defaulted on its debts, it has seen strong growth, rising living standards and steep reductions in poverty and inequality. Unsurprisingly, Argentinians have rewarded the Kirchners for this success.

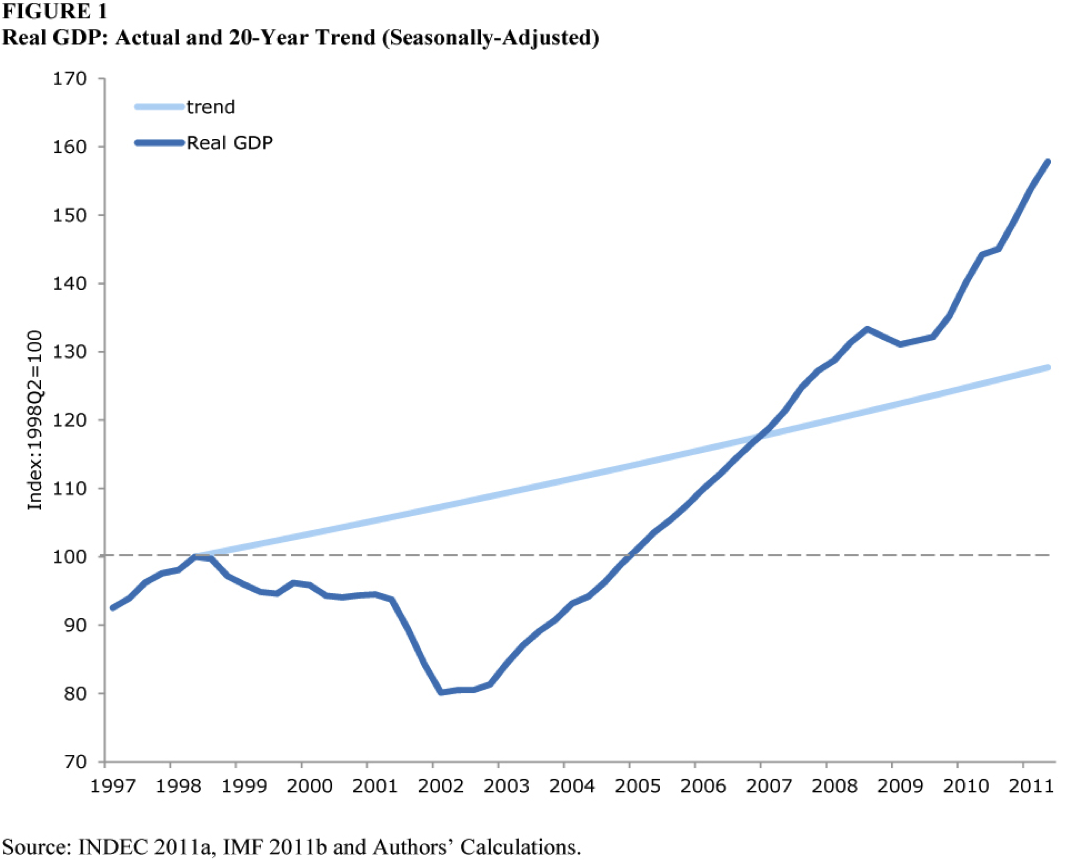

Indeed, according to this new study by the Centre for Economic Policy Research, Argentina has had the fastest growth of any country in the Western Hemisphere in the period 2002 – 2011, achieving a remarkable 94% increase in its GDP. Meanwhile, poverty has fallen by two-thirds from its peak, unemployment by half, and social expenditures have trebled in real terms. This is a record most policymakers would be delighted to emulate.

It has done this in the teeth of orthodox economic policy advice. In the 1990s, Argentina was an IMF poster boy, but it soon became a byword for the failures of the Washington Consensus. Tying its currency to the dollar, cutting public spending and selling its assets led to a deepening debt spiral from which it could not escape until it defaulted. Once it had broken free of the dollar peg and unsustainable debts, the Kirchners put growth and jobs first, holding down the currency, investing in anti-poverty drives, paying off the IMF and refusing to settle with “vulture creditors”. This was not good luck, contingent on an export boom, as their critics allege, but a set of strategic choices that have paid off.

The question is whether it is sustainable. Hitherto, the price that has been paid for this success has been rising inflation, which is now running at 25%. Over time, inflation at this level will erode Argentina’s competitive advantages. If Argentina is to avoid another crash, Fernandez will need to start to bring inflation down. Whether she can do so without imperilling growth and living standards will be the central test of her second term (longer term, Argentina needs to cement constitutional-democratic reforms, in order to leave its 20th century cycles of populism and authoritarianism firmly behind).

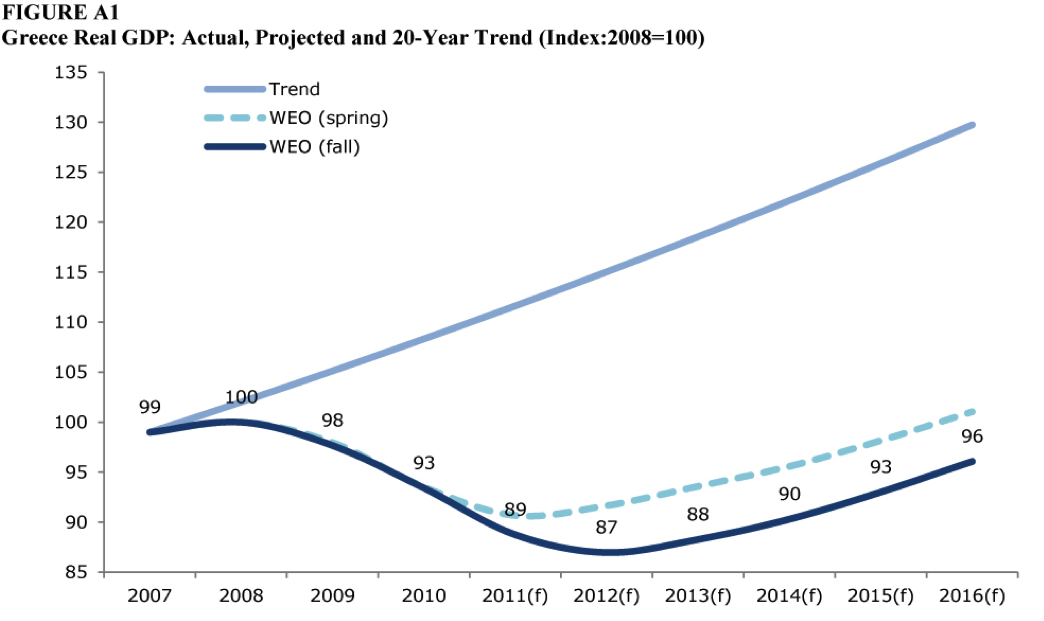

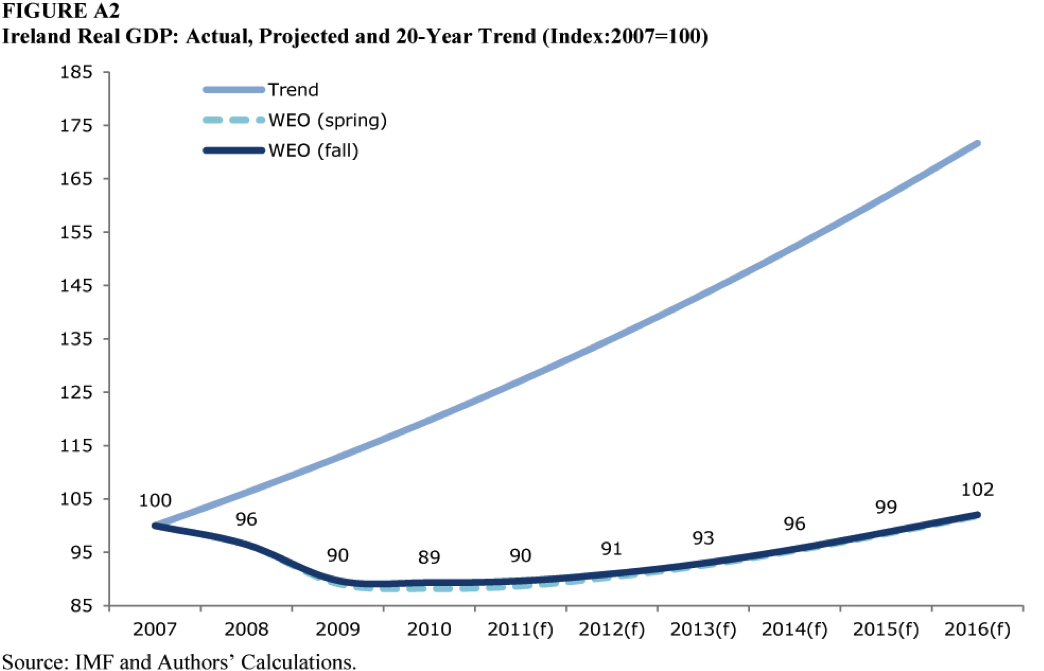

But for now, heterodoxy has paid off in Argentina, just as it has in Iceland, as Paul Krugman has recently observed. Compare their fate to what Greece and Ireland can expect in the years ahead:

Nick Pearce is director of the Institute for Public Policy Research, a UK based progressive thinktank.

Originally published on Open Democracy under a Creative Commons cc-by-nc 3.0 license. {jathumbnailoff}

Image top: Franco Folini.