All is well - All is really, really well

Tax revenue is falling off and the current account deficit is growing. The €130 million in health cuts is just the start; there is more, much more, in store for us. By Michael Taft.

The Exchequer figures are out. And they are not good. Coming into this year, the Government had a strong wind at its back, with €1 billion being carried forward from Budget 2011. That wind has blown itself out and the Government is looking at a deteriorating situation.

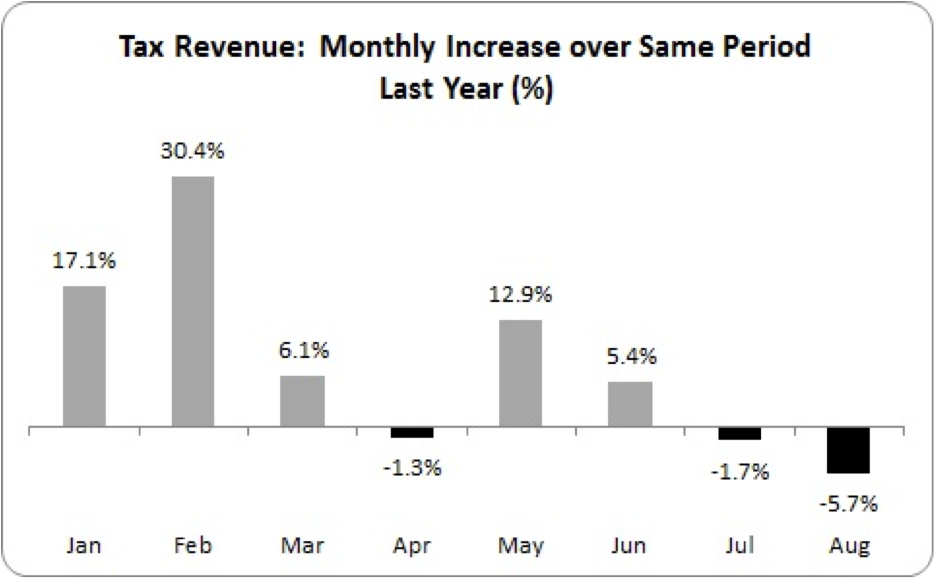

The best way to compare tax returns is not necessarily with targets. Targets can be moulded in ways to show all manner of results; for instance, set low targets that you know will be achieved .and voilà, you have succeeded. A better way is to compare with last year. In that way, we can see how the economy is performing.

As seen, in the first two months of the year, tax revenue was significantly higher than in the same period last year. This reflected the carry-forward mentioned above. However, since then, returns have been disappointing. Falling in March and April, it rose again in May. However, since then it has been downhill. Tax revenue in July and August was below the tax returns of last year. Dan O’Brien points out:

As seen, in the first two months of the year, tax revenue was significantly higher than in the same period last year. This reflected the carry-forward mentioned above. However, since then, returns have been disappointing. Falling in March and April, it rose again in May. However, since then it has been downhill. Tax revenue in July and August was below the tax returns of last year. Dan O’Brien points out:

“In the June-August period, tax revenue was below the same period last year. This is the first time since 2010 that a year-on-year decline in revenue has been registered for a three-month period.”

There is another important note: not only did the Government benefit from a €1 billion carry-forward, it also increased taxes. Approximately €1 billion in additional tax revenue was pencilled in for 2012. However, not all that will accrue to the Exchequer and, so, will not appear in the Exchequer numbers (increase in PRSI payments go the Social Insurance Fund while the Household Charge is a Departmental receipt). Still, with a €1 billion carry-forward from last year and hundreds of millions more in new tax measures, tax receipts are starting to decline over last year.

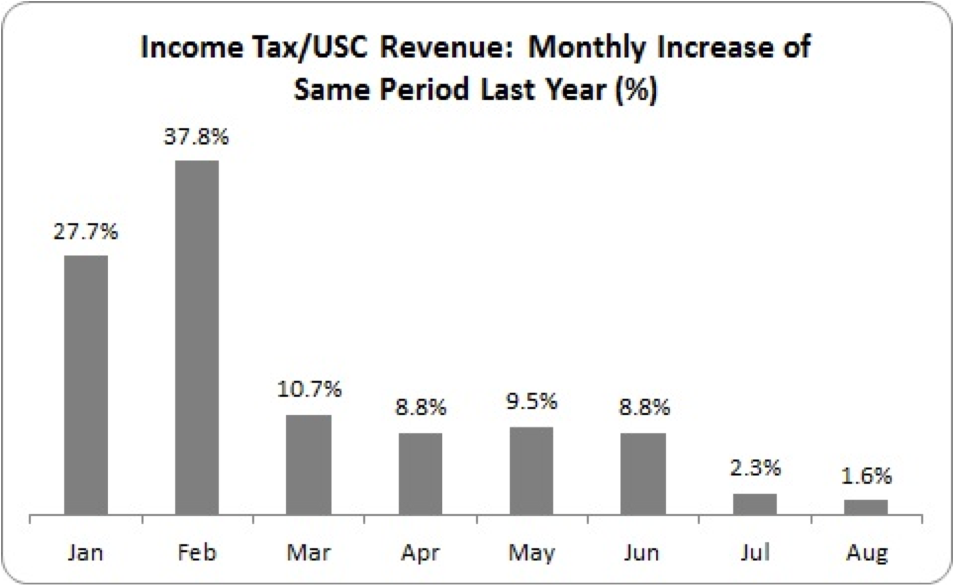

When we turn to income tax/USC receipts we see the same trend.

The big boost in the first two months reflects the €1 billion carry-forward. Afterwards income tax/USC remained steady. However, in the last two months we have seen a considerable fall. But as always with Exchequer returns, there are small caveats. Some of this revenue should actually be earmarked for the Social Insurance Fund (being PRSI receipts). The above, therefore, slightly flatters revenue figures. Whereas to the end of August, the Exchequer figures show income tax/USC revenue to by 12.9% higher than last year, in the Information Note the Department of Finance admits that the figure is below 10%.

The big boost in the first two months reflects the €1 billion carry-forward. Afterwards income tax/USC remained steady. However, in the last two months we have seen a considerable fall. But as always with Exchequer returns, there are small caveats. Some of this revenue should actually be earmarked for the Social Insurance Fund (being PRSI receipts). The above, therefore, slightly flatters revenue figures. Whereas to the end of August, the Exchequer figures show income tax/USC revenue to by 12.9% higher than last year, in the Information Note the Department of Finance admits that the figure is below 10%.

With regards to VAT, receipts are €208 million, or 3.1% higher than last year up to the end of August. The Government is hoping VAT will bring in €254 million more than last year by the end of December, or a 2.6% increase. However, we should remember that the Government estimated that the VAT increase would yield €560 million. The discrepancy can be put down to lower consumer spending. The VAT increase would have contributed to this lower spending. The point here is that an adjustment of €560 million will actually only yield an increase of less than half that amount.

It may well be that things will improve later this year – especially with the self-employed receipts. However, at this stage, Exchequer returns are deteriorating. Seamus Coffey shows that when you strip away bank capitalisations and once-off payments, the current budget deficit is getting worse (this measures all current expenditure).

“All told, in the first eight months of 2012 the overall current budget deficit is €429 million bigger than it was last year.”

So tax revenue is falling off, the current account deficit is growing. And the €130 million in health cuts is just the start; there is more, much more, in store for us.

But hey, don’t worry, we’re hitting our targets. Go back to sleep, Ireland. All is well.

Image top: AKZOphoto.