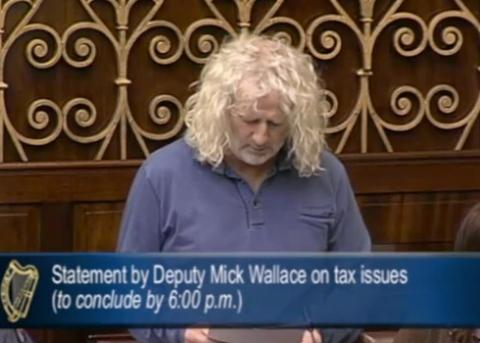

Mick Wallace's Dáil statement on under-declaration of VAT

I would like to thank the party whips and the government for giving me the opportunity to speak today. In relation to my company’s under-declaration of VAT in 2009, M&J Wallace Ltd sold apartments in 2008 and 2009 and the proceeds from the closings of the sales were pledged to the bank. Normally, the business cash flow would have allowed us to deal with the VAT liability but not on this occasion. In early 2008, the company had got the go ahead to build a large project on the North Circular Road, which gave confidence in its potential to go forward. Towards the end of the year, the bank pulled the plug on the project. This meant serious and unforeseen cash flow problems for the company. M&J Wallace Ltd had committed a lot more money to the project than it ultimately received from the bank, it had to let some men go, pay redundancy, it was coming under pressure for payment from suppliers and subcontractors, and having to deal with four banks becoming increasingly aggressive. The company was not able to pay the VAT at the time but was convinced that it was possible to work our way through the crisis. M&J Wallace Ltd believed that the company would be able to pay the full amount within six to twelve months. It was feared that if the problem was revealed at that time that either the Revenue or the banks would have moved against the company and put it out of business.

The manner in which the VAT was dealt with was, in hindsight, an error of judgment made under pressure at a time when the approach of the banks was changing dramatically and the value of property was dropping sharply. There was never an intention that the money that was owed would not be paid to Revenue and the motive behind the underpayment was to delay payment in order to trade out of difficulty. Few at the time predicted that the country’s economic woes would continue as long as they have. We were never big developers which meant that we did not go into NAMA as the company’s debts were not large enough with the Irish banks, most money being owed to foreign banks, which are not subject to State guarantee and who have been more aggressive in their pursuit of debts as a result. The company had traded successfully for twenty years and it meant so much to me. People have said that if M&J Wallace Ltd had not under-declared its VAT, the Revenue would have worked with the company and maybe that is true – hindsight is a great thing – though at the time it appeared that flexibility was in short supply.

The following year 2010, the situation had continued to deteriorate and the company made a full declaration to the Revenue and opened its books. The Revenue then proceeded to carry out a full audit of the company’s books and after some weeks, an agreement was reached between both parties whereby a sum of money would be paid each month by the company to the Revenue to deal with the outstanding amount, and all other ongoing tax liabilities would be honoured. When I stood for election in February 2011, I personally had a tax clearance cert, and so too did M&J Wallace Ltd as it was meeting the terms of its arrangement with the Revenue. The company was sourcing work, paying the Revenue, paying off as many subcontractors and suppliers as possible, and this continued to be the case up until November 2011 when, following a €19.4 million judgment against the company by ACC Rabobank, M&J Wallace Ltd was no longer able to get work due to the judgment. I should add that all payments regarding PAYE, PRSI, pensions and redundancy were made but unfortunately the VAT and a number of subcontractors were left being owed money.

I have strived to demonstrate the distinction between my personal tax affairs and those of the limited company M&J Wallace Ltd. In legal and company terms, they are two separate entities, something which everyone in business will recognise, and without which no one would ever risk enterprise. I understand that many people do not see it this way. My personal tax affairs are in order and, for twenty years, M&J Wallace Ltd paid all taxes due, until the company found itself in its recent troubles and failed to meet the VAT obligation in question. In view of the fact that I now work for the people, and am paid by the people, I feel obliged to look beyond the bounds of company law. I understand that many people suffering under vicious austerity were upset by my statement last week that M&J Wallace Ltd would not be able to repay the tax debt – this was not a cavalier comment but rather an honest statement of fact. I understand that PAYE workers and social welfare recipients are not afforded this flexibility, although life for most people in small and medium sized business is far from rosy either. In solidarity with the citizens of this country I will strive to personally make repayments in relation to the tax debt of M&J Wallace Ltd, and to this end, starting immediately, I am taking steps to organise for half of my Dáil salary to go towards paying M&J Wallace Ltd’s VAT liability with the Revenue.

I have been told that I have not presented my case well and that I should have hired a PR company to help me make my presentation. Rightly or wrongly, that hasn’t been my way of doing things. I didn’t come in here today to defend the indefensible – the company under-stated its VAT liability and we were wrong to do so. I want to apologise and say sorry to all the people who expected more from me, I want to apologise to the members of this Dáil for bringing any dishonour on a profession which hardly needed it, I want to especially apologise to the people of Wexford – I went home last weekend and found it hard to believe the support that I was given, the manner in which people can find it in themselves to offer support to somebody who has done something wrong, and who is down – it would boost anyone’s faith in human nature. I want to apologise to people all over Ireland, particularly to those who have supported and continue to support me and no matter what happens, I will never forget them. I have done many things in my life that I should not have done, and now I have disappointed many people who believed in me.

Some members of this Dáil have suggested that I should resign the seat for a mistake made by the company M&J Wallace Ltd before I was elected. Have I considered resigning and running in a by-election? Yes, I have. Have I considered resigning and walking away from politics for good? I certainly have. But I was never very good at quitting. I did go into politics with a desire to work for social justice, to challenge the lack of fairness that exists in our society, and to strive to make this country a better place to live, for all of us.

I am grateful for the support I have received from the small and medium sized business community who know how difficult things can be and what the pressures of business can be like. As well as support from small business people, I have been greatly heartened by the many messages of support from all over Ireland in general and from Wexford in particular. As a TD for Wexford, I feel privileged to have met so many wonderful people living quietly extraordinary lives and worked with them on many issues such as Cuts to Special Needs Assistants, Resource Teachers and guidance counsellors, Problems with the Domiciliary Care Allowance and the Carer’s Allowance, Changes to the One Parent Family Payment, and a host of other issues – in short, it is an honour and a privilege for me to represent the people of Wexford. They say that those of us who speak out should be above reproach, but I would be at pains to stress that I will never be that. I’m just another human being who is very far from being perfect and will remain so. I am answerable to the people of Wexford who elected me and they will discard me when they see fit, it is their seat not mine. In the meantime, I will strive to serve them, and all the people of Ireland, as well as I can.

{jathumbnailoff}