Spending cuts are a political choice

A look at the basic numbers shows that the Government does not need to cut overall spending. If it does, it's because it has chosen to do so. By Michael Taft.

With the Government to publish its four-year plan in the next few weeks, we should try to nail down some basic numbers. No doubt the plan will present an avalanche of numbers and percentages and projections, so much so that the Government may well try to hide some discomfiting statistics. Does this sound cynical?

Let me give one example of what the Government has already done: it has extended and deepened austerity measures without telling anyone.

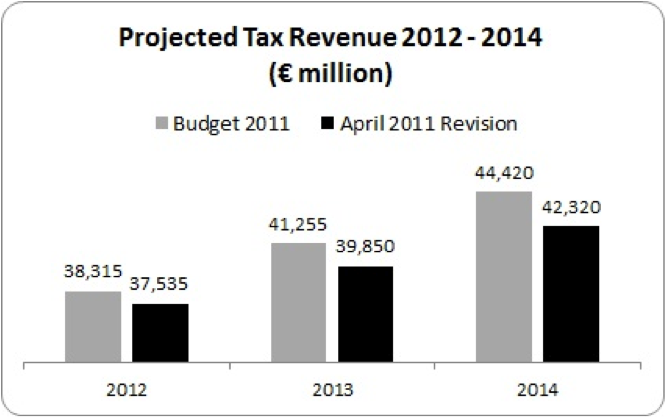

When the Government took office they found a €4.2 billion hole in the projections presented by the Fianna Fáil government in the last budget (these were the projections that the EU and IMF announced full confidence in).

In just a few weeks, the new Government found tax revenue falling by €4.2 billion below Fianna Fáil projections. Why did this happen? Because they projected growth to be lower (the lower the GDP, the lower tax revenue). This put the entire austerity strategy at risk.

So how did the Government respond? They first extended the target date to reach the Maastricht guidelines (that is, to reduce the deficit to 3% of GDP) to 2015 since there was no way they could do it by 2014. They then inserted an additional €2 billion in austerity measures in 2015.

Did they tell anyone? No. Did they publish this when they presented the revised projections in the April Stability Programme update? Kinda, sort of. They put it in a footnote on Table 10. It didn’t even merit a single sentence in the text. At one level this is understandable. The revised projections were published at the same time as they announced the Jobs Initiative. It wouldn’t have been very inspiring if the Finance Minister announced all manner of proposals to increase jobs and then said, “Oh, and by the way, we’re going to hammer you for another €2 billion in austerity.” Wrong signals and all that.

So we’re right to be alert. Here I just want to focus on one issue – how much fiscal consolidation (tax increases and spending cuts) the Government is required to introduce in the next budget.

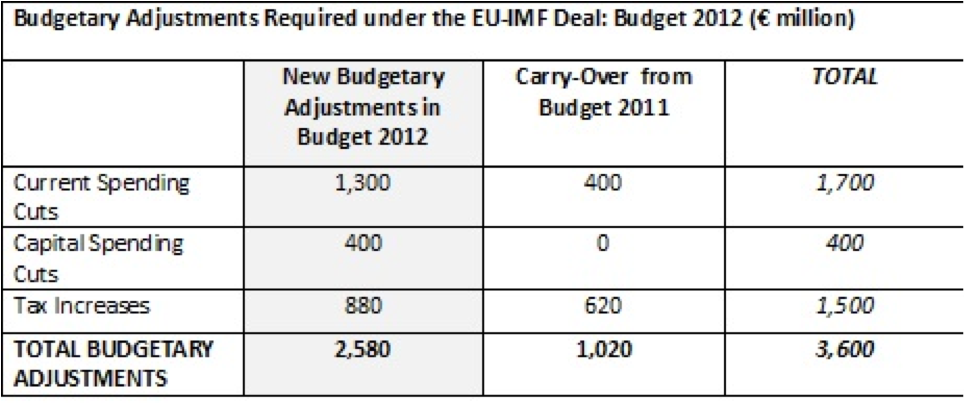

It is commonly asserted the Government must introduce €3.6 billion in fiscal consolidation measures. However, this figure is not what it seems, as it includes what are called ‘carry-overs’. An example of this is the introduction of the Universal Social Charge in the last budget.

In 2011, the USC was introduced on a cost neutral basis (replacing the income and health levies). However, on a full-year basis, it will raise €400 million. This occurs because tax is collected in arrears. Tax collected in January and February comes from the last month of the previous year. Similarly with spending cuts – there are carry-overs from one year to the next.

The fiscal targets in the National Recovery Plan – which formed the basis of the EU-IMF deal and which was accepted by the new Government – listed the ‘new’ fiscal consolidation measures that had to be introduced for each year, along with their carry-overs:

The total amount required through ‘new’ fiscal consolidation measures is not €3.6 billion but actually the €2.6 billion in the New Budgetary Adjustments in Budget 2012 column. The remainder is made up of carry-overs.

But there’s another twist to this stat-fest. The actual total of carry-overs from Budget 2011 was projected to be higher than the table above taken from the National Recovery Plan/EU-IMF deal. If these projections hold (and they will probably slip a bit), the actual new fiscal consolidation the Government is required to bring about will be less.

If we factor in the actual carry-overs from Budget 2011, the Government need only bring in €1.9 billion in ‘new’ fiscal consolidation measures – because the carry-overs are higher than anticipated under the National Recovery Plan/EU-IMF deal.

So where does all this get us?

- We should focus on the amount the Government is required to bring in through ‘new’ fiscal consolidation measures

- The ‘new’ fiscal consolidation measures required are anywhere between €1.9 and €2.6 billion (depending on the actual amount of carry-overs)

As we know, the Government has stated that it has policy freedom to substitute tax increases and spending cuts as long as the value remains the same. Therefore, the Government could introduce a budget made up totally of tax increases. And this raises the very real possibility that new tax increases on high-income groups and capital/property could easily reach the level of ‘new’ fiscal consolidation measures.

In other words, the Government does not need to cut overall spending. If it does, that is a political choice.

Knowing this, we will be better able to assess the politics of the Government’s budget – and we will know where the Government intends to turn up the austerity heat. Already, they are claiming that the fiscal consolidation targets are not important (even though they specifically commit themselves to those same targets).

Now they are shifting the goalposts – claiming that it is the overall deficit that is the actual target.

And, on this basis, they will have to increase the austerity measures. Why? For the very same reason that they slipped in an extra €2 billion without telling anyone: namely, that austerity is depressing growth which in turn drives down tax revenue and increases unemployment costs.

Missing and readjusting targets because of the impact of austerity is becoming a bit of sport lately with Irish governments.

A sport that we are losing. {jathumbnailoff}

Image top: Fine Gael.