Welcome to the inequality cycle

Data from the Survey on Income and Living Conditions 2010, published by the CSO yesterday, shows that in 2010 Ireland experienced the biggest single year jump in income inequality recorded in any country since the EU started recording this data. By Michael Taft.

We are now starting to get data to assess just who in society is getting hit and who is getting by what. Of course, we know about unemployment rates, deprivation rates, and income inequality rates. But the CSO’s 2010 Survey of Income and Living Conditions gives us an insight as to who has lost how much in the first two years of the crisis, namely 2009 and 2010. Let’s take a particular look at three deciles – the lowest, the highest and the middle 6th decile.

First, what levels of income are we discussing within these groups?

- The lowest decile includes households with gross incomes of €13,249 or less; or approximately €10,000 per adult in the household.

- The middle decile includes households with gross incomes between €37, 467 and €46,561; or approximately between €18,000 and €21,000 per adult in the household. (Question: is this the squeezed middle that the Irish Times series was recently chronicling?)

- The average for the highest household is a gross income of over €171,000; or approximately €62,000 per adult in the household.

For the lowest decile, income levels are extremely low, while in the middle decile, incomes are extremely modest. Incomes at the higher level are in another place altogether.

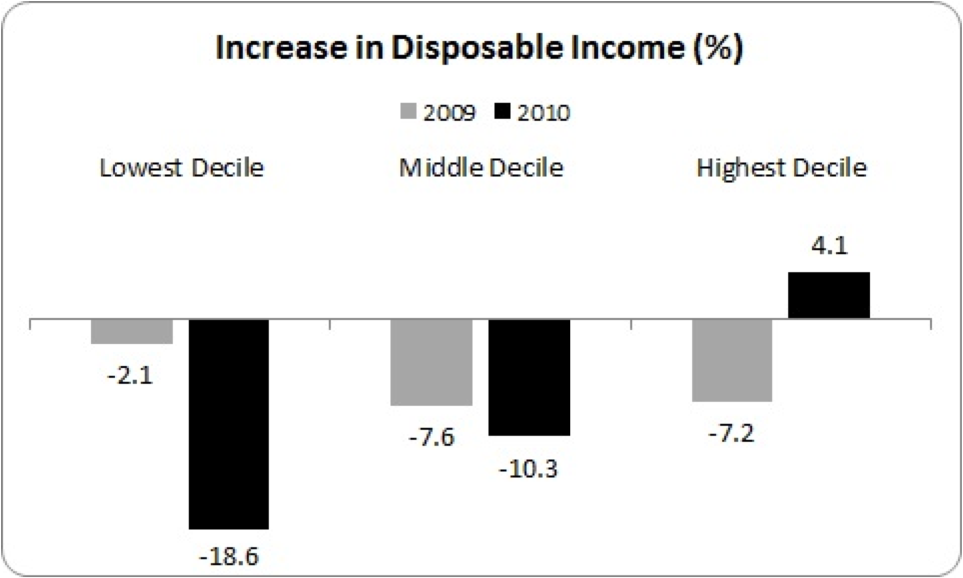

Now, let’s look at disposable income – that is, income after tax.

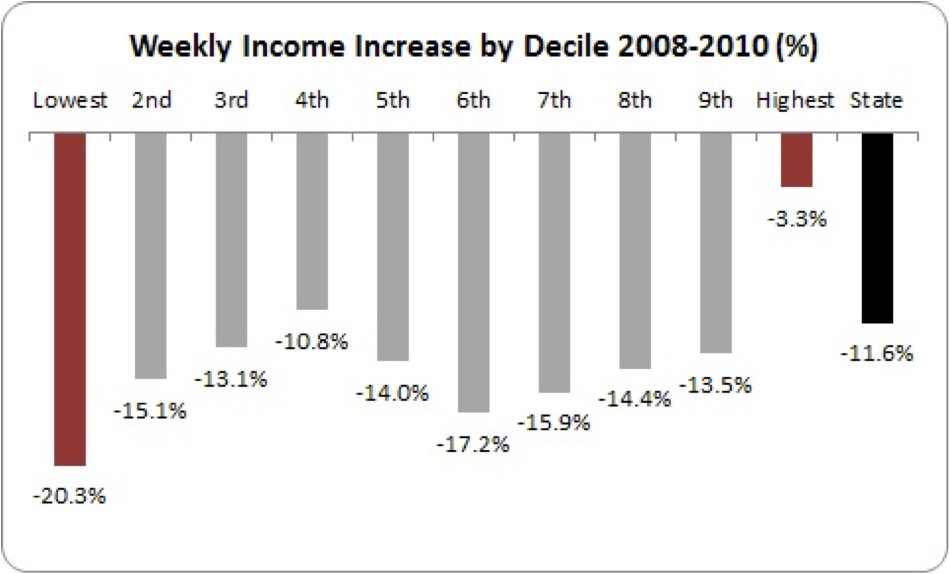

Nationally, weekly income fell by nearly 12% on average. However, as seen, the worst hit were those who could least afford it, with the lowest 10% income earners experiencing a fall of over 20%. The next biggest decline is found in the middle 6th decile. All deciles experienced a fall in double digits with one exception: the highest earners pretty much escaped the impact of the recession.

However, the story is a little more complicated.

In 2009, the lowest decile experienced a minimal impact. It was the middle decile that took the biggest hit, with the highest income earners also experiencing a significant decline. However, the picture changed in 2010. The lowest income groups experienced substantial income decline – in this year social transfers were cut. The middle-income group suffered further decline. However, the highest income groups returned to growth.

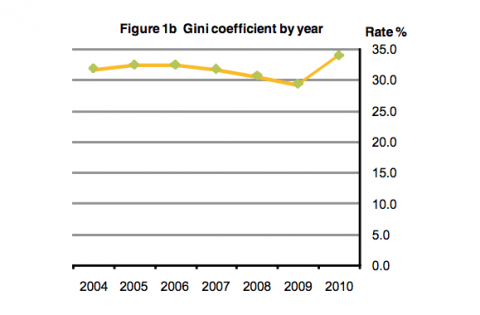

The SILC data shows that income inequality experienced a large rise in 2010, rising from a ratio of 4.3 to 5.5 (the ratio of the income of the top 20% to the bottom 20%). This was the biggest single year jump in income inequality experienced in any country since the EU started recording this data. In 2010, Ireland ranked 9th in the EU-27 for income inequality.

These trends are likely to continue and may even accelerate. The 2011 budget saw further cuts in social transfers combined with highly regressive tax measures (the USC and the reduction in personal tax credits). The 2012 budget – which the ESRI described as the most regressive of all budgets introduced since the crisis began – will further exacerbate this.

So we have a new cycle to discuss – alongside the deflationary cycle, the debt cycle and the long-term unemployment cycle: the inequality cycle. And this is likely to be as vicious and socially degrading as the others. {jathumbnailoff}